IRR is a term widely used in real estate. But what is it?

IRR stands for Internal Rate of Return. It reflects the annualized Return On Investment (ROI) of an investment and it counts in all the profits generated by the investment from the time of acquisition until the disposition of the investment.

IRR can describe the ROI on a different type of investments and it is great for comparing investment tools as it put all types of investments on the same scale.

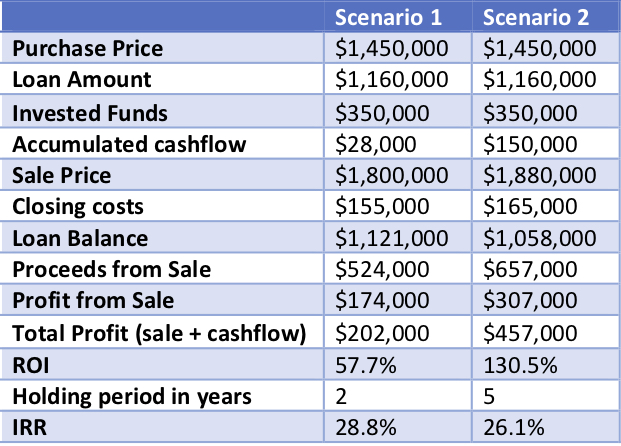

The IRR is presented in % per year over the invested funds. Let’s look at a couple of examples from the real estate world*:

*I have used realistic numbers that were rounded for simplicity

From this example, you can clearly see that having higher ROI doesn’t mean higher IRR. ROI doesn’t take into account the time factor on your investment and IRR does.

When you are considering different investment tools make sure you are comparing the IRR and not the ROI since your money has to work overtime…

If you have questions or comments, please reach out to us at info@kerra-investments.com

Invest your money wisely!!

If you would like to get notified on new investments that might generate high IRR, register to our newsletter at www.kerra-investments.com

Eliav Kling